The secondary market is a fast-growing and increasingly important part of the private equity industry. In 2021, it accounted for $132 billion in transactions, up from $26 billion in 2011, and it’s expected to grow even more in the future as investors continue to invest in secondaries across all segments.

Secondary transactions are the purchase of existing private equity funds by new investors. The secondary market has emerged as a new way for investors to participate in private equity and has become an important asset class in itself, with secondary funds typically outperforming primary fund investments over time.

The secondary market has many benefits for investors and sellers. For buyers, it offers access to attractive investments in private equity funds with reduced J-curve as well as opportunities to diversify their portfolios with known assets. For sellers, it allows them to rebalance their private equity portfolio while locking-in returns and generating liquidity. As secondary transactions become more common, they’re also becoming more standardized, which makes them easier for investors of all sizes to get involved.

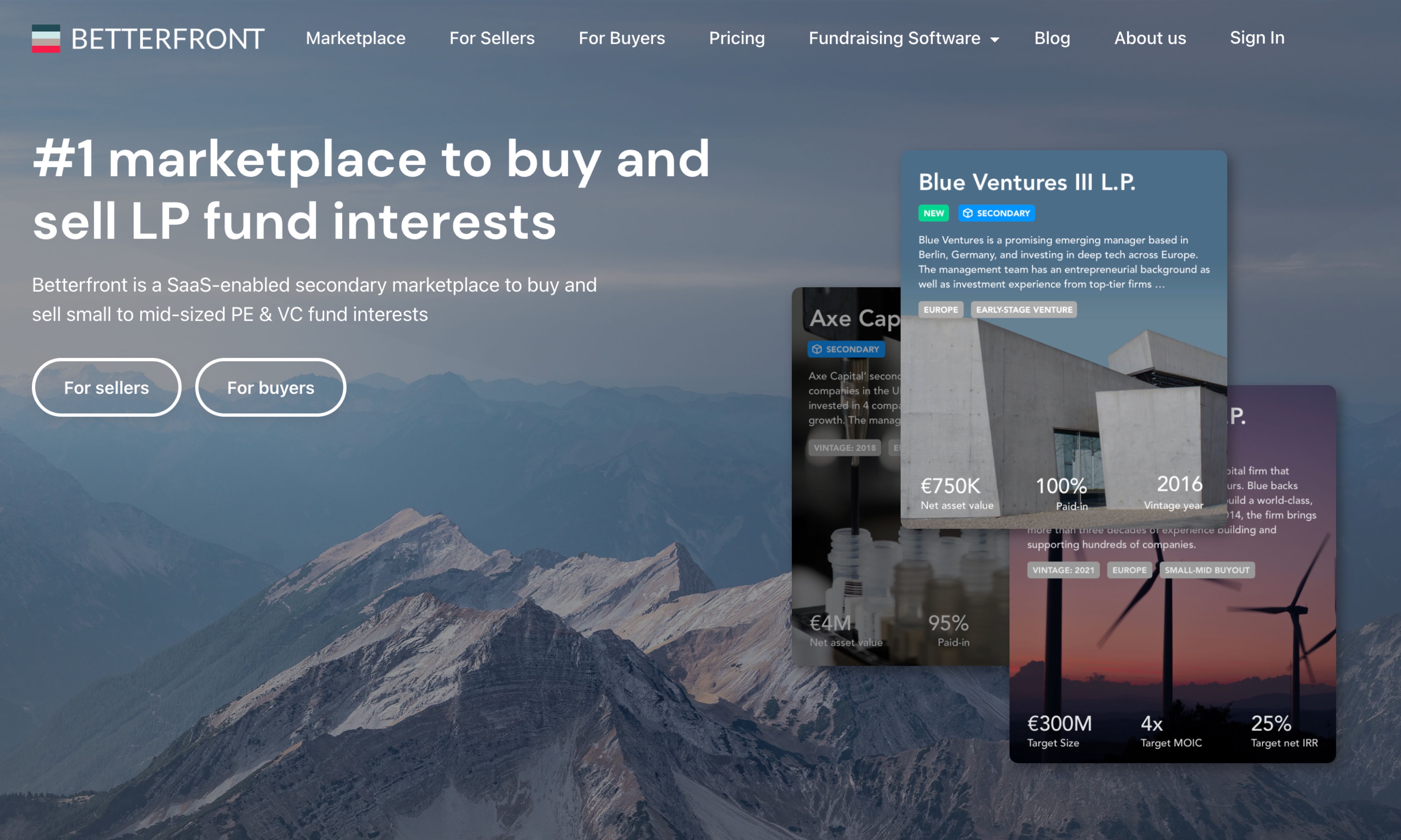

The Betterfront Secondary Marketplace

Betterfront’s SaaS-enabled secondary marketplace is designed to make it seamless to transact LP fund interests. We provide a full suite of products, including secure document sharing and pricing analytics, in order to help facilitate secondary transactions as quickly as possible.

What’s more, our marketplace simplifies the process of managing secondary transactions by providing a single platform for all parties involved. For example, we enable sellers to list fund interests for sale and receive pricing from multiple buyers, while also allowing buyers to review offers and make an informed decision about their potential bids. GPs can be involved during the listing and sharing phases if needed. This approach allows us to provide a better solution at a lower cost than most traditional providers—and it means that even small sellers and investors can participate in these deals.

Breaking down the barriers

Our marketplace has been designed to overcome the barriers that traditionally prevent sellers and buyers from interacting with each other. These include:

- Lack of transparency: many secondary marketplaces don’t provide enough information about the fund interests they list for sale, making it difficult for investors to make informed decisions about their bids. This can lead to higher prices or an inability to complete transactions at all.

- Lack of buyers: in many situations, sellers are left with a ridiculously small universe of buyers, which limits the number of bids and the potential for a better price.

- Slow transaction times: existing solutions typically require a significant amount of time from start to finish when transacting in secondary private equity fund interests.

We are very excited to share the release of our new marketplace with you and hope that you find value in it. Please let us know how we can continue to improve the marketplace and if there are any other features or functionality that would be helpful for you.