Source and analyse

VC & PE funds

Discover private equity & venture capital primary fundraisings and secondary transactions currently in the market.

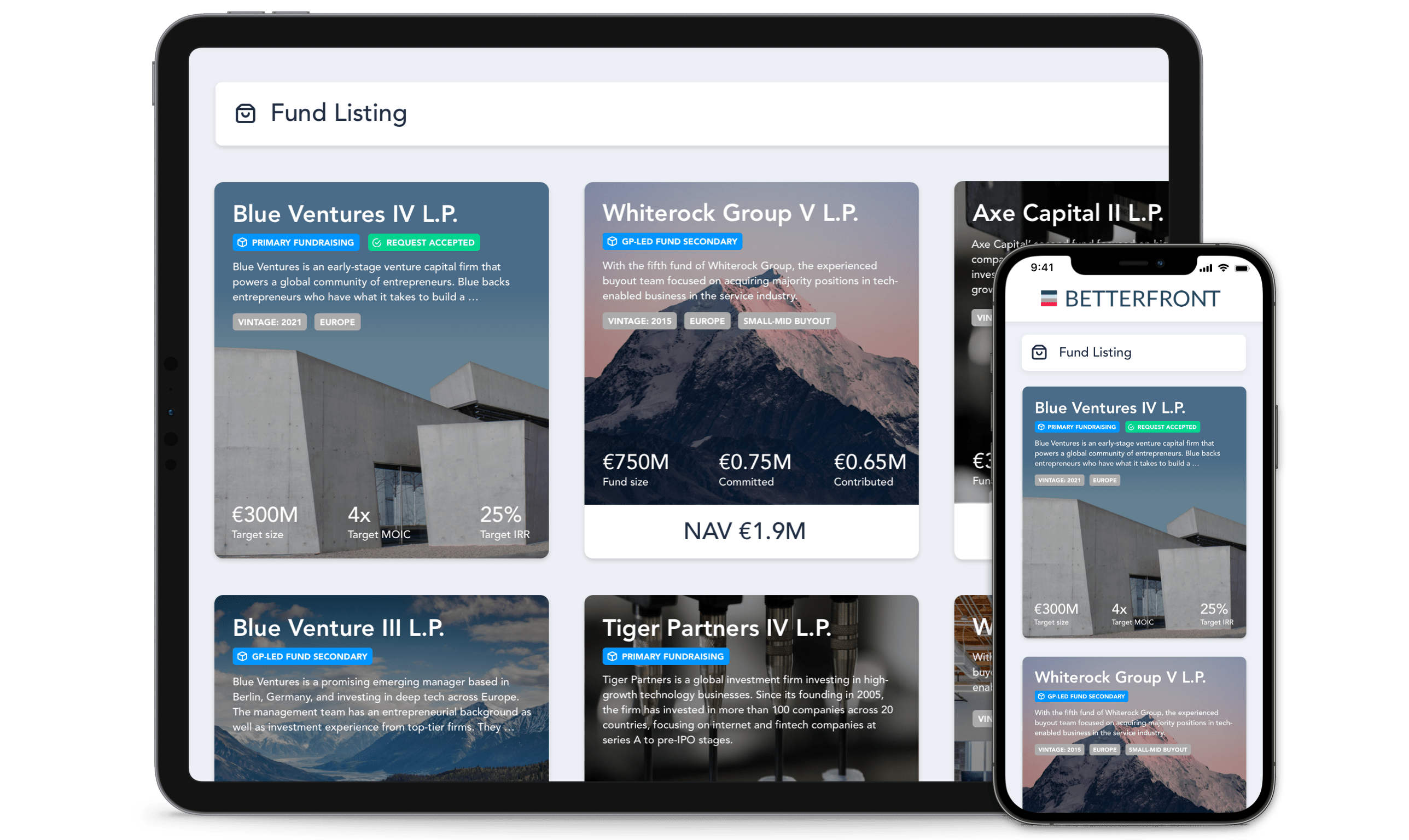

A SaaS-enabled marketplace

for PE & VC funds

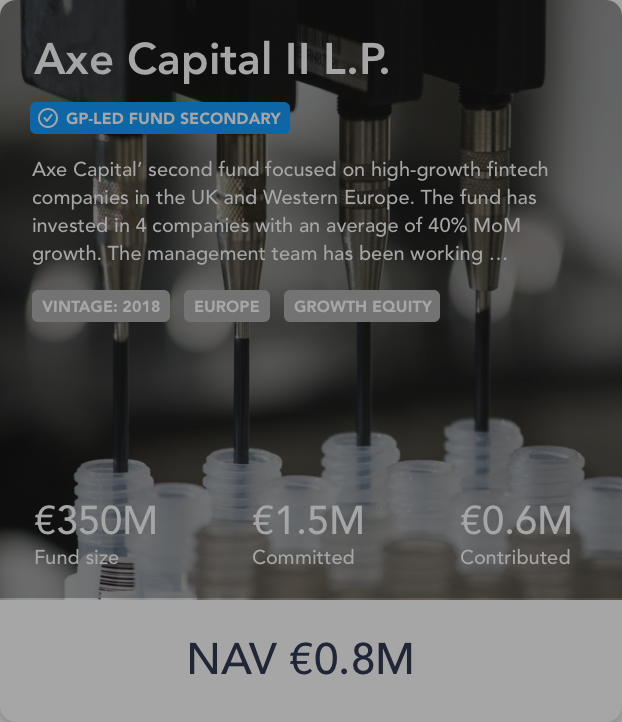

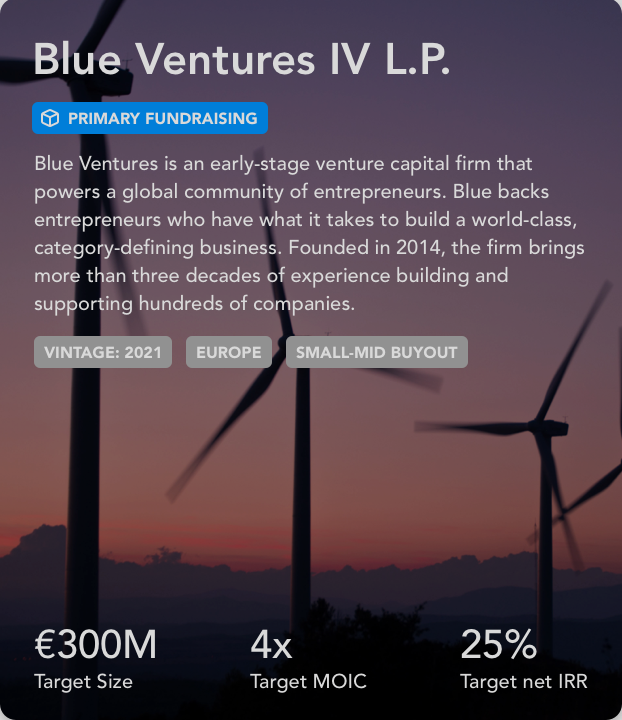

Marketplace Listing

Source fund opportunities active in the market

Access listing of primary and secondary fund opportunities that match your investment preferences across asset classes, strategies, regions and transaction types.

Track record

Analyse track records with purpose-built analytics

GPs’ track records are key to your due diligence. That is why all listings include Betterfront’s proprietary track record analytics solution with GP-provided track record data.

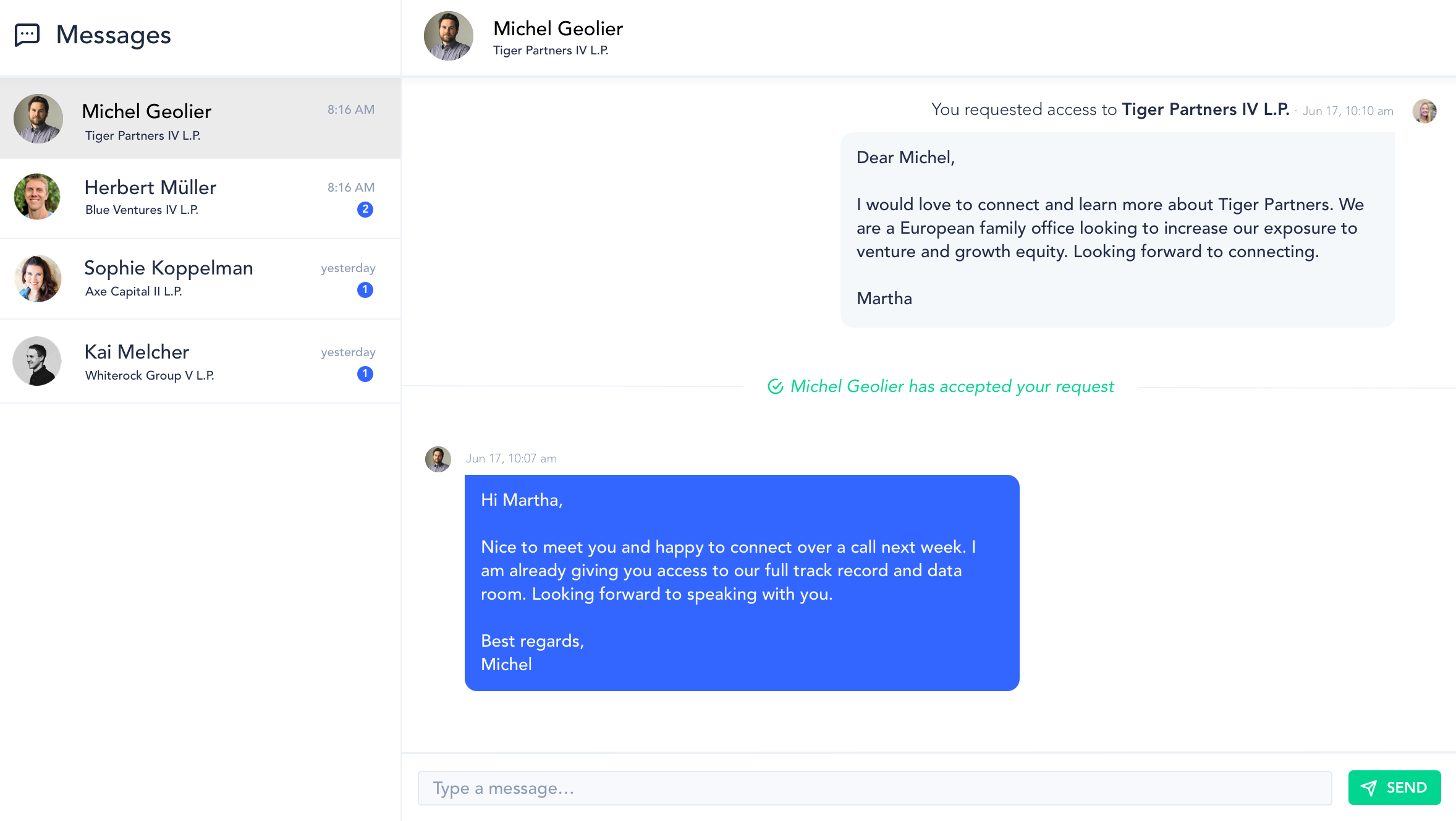

Request Management

Connect with GPs and access more information

Once you are ready to move forward, send a request to communicate with GPs and access their data rooms directly in Betterfront.

How it works

1

Apply to join the platform - it’s free

2

Betterfront reviews your application

3

Access listings and connect with GPs

More than €4B is being raised using Betterfront

Get In Touch

We'd love to hear from you.

Join Our Team

Where To Find Us

Betterfront Technologies GmbH

Kaufingerstr. 15

Munich, Germany

80331